45+ are points paid on a mortgage tax deductible

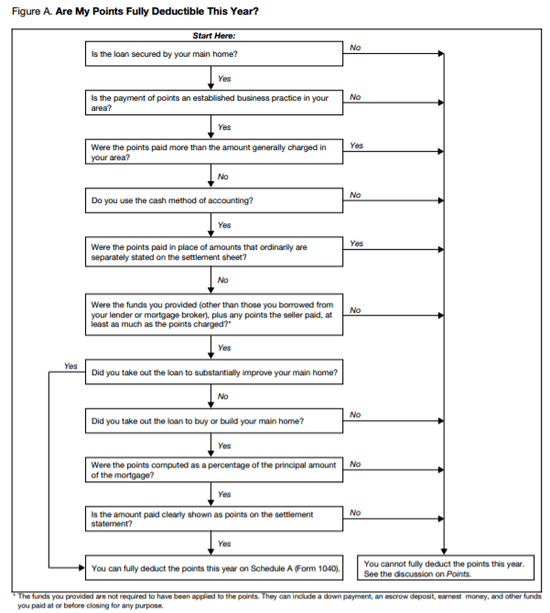

Web Most homeowners can deduct all of their mortgage interest. Web Generally you cannot deduct the full amount of mortgage points in the year paid as they are considered prepaid interest and must be deducted equally through the.

Best Credit Repair Companies For 2022 Fix Your Credit Score Fast

Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

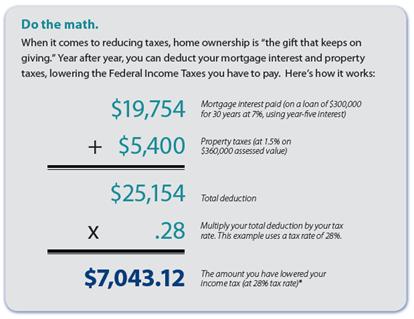

. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Taxes Can Be Complex. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

If you buy a. Taxes Can Be Complex. In some cases a borrower will pay more in points to get a lower interest rate over the life of the mortgage.

Understand The Home Buying Process Better. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Mortgage points are considered.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Private mortgage insurance Not so great news. Married taxpayers filing separately.

Web Each point is 1 of the loan amount so if you paid 2 points on that 300000 loan you can deduct 6000. Web Married taxpayers filing a joint return. Written by Melanie Mergen Reviewed by.

As far as filing taxes goes claiming a tax deduction for mortgage points is a fairly straightforward process. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. Web How to Deduct Points.

On smaller devices click in the upper left-hand. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined.

Web To enter the deduction of remaining points on a refinanced loan. Web One point is equal to 1 of mortgage loan. If you are over 65 or blind youre.

When you deduct points paid by the. Web If you meet all the above criteria you can either deduct all your points in the year you paid them or deduct them in equal increments over the life of the loan. So the buyer can deduct these mortgage points.

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Homeowners who are married but filing. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

From within your TaxAct return Online or Desktop click Federal. Homeowners who bought houses before December 16. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Ad Our Simple Guide Will Help You Understand Common Mortgage Terms. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Mortgage points may be fully tax-deductible the year they were paid but a homeowner has to meet the right set of criteria.

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web Points the seller pays for the buyers loan are usually considered to be paid by the buyer.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Energies Free Full Text Energy Transition Of The Coal Region And Challenges For Local And Regional Authorities The Case Of The Be 322 Chat Oacute W Basin Area In Poland

Naca Mortgage Guide Program Requirements Freeandclear

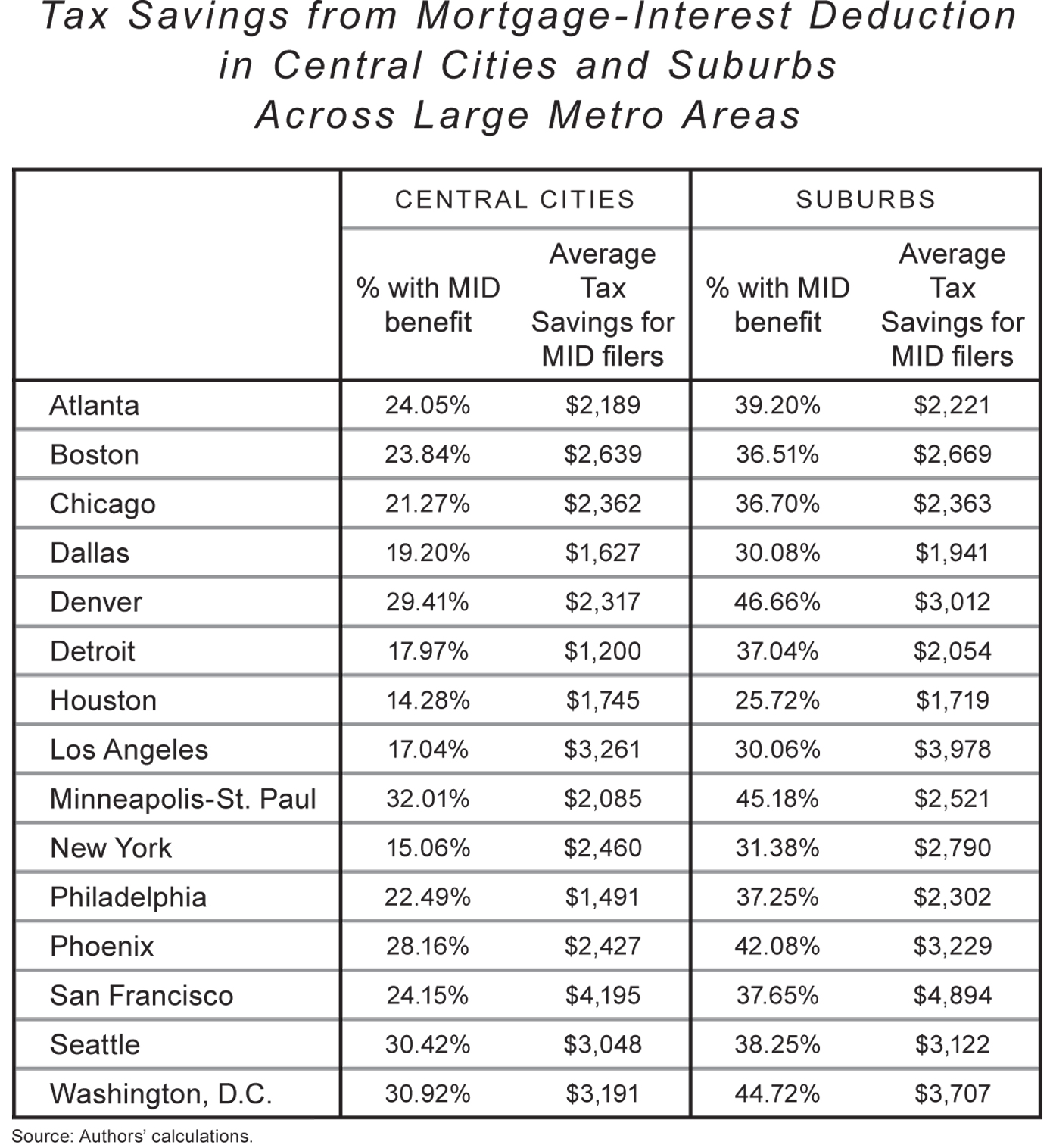

Rethinking Tax Benefits For Home Owners National Affairs

Home Mortgage Loan Interest Payments Points Deduction

Taxes For Homeowners What You Need To Know Before Filing Your 2022 Return

Reasons Why You Should Not Buy A Vacation Property

Cmp 8 02 By Key Media Issuu

Retirement Wikiwand

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Compare Credit Cards With Travel Insurance Canstar

Paying Off Mortgage Early The Good The Bad And The Ugly

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction How It Calculate Tax Savings

They Completely Understand Loan Forgiveness R Insanepeoplefacebook

Lender Tricks Mortgage Borrowers Should Know About Freeandclear

How Can One Retire By Age 45 Quora